Well when it comes to the world of life insurance, there is an option to make your premiums more stable: level premiums. This approach can create some comfort and certainity in the later years.

Basically, you pay a bit more now to pay a lot less later. Leveling your premiums can be great for managing your cash flow in future years, especially when you might actually want more cash in hand. The smart move is to take a hybrid approach, some on the standard premium but a portion on level premium. That way, later in life, when you might not need as much cover, you can have the luxury of keeping some manageable cover alive.

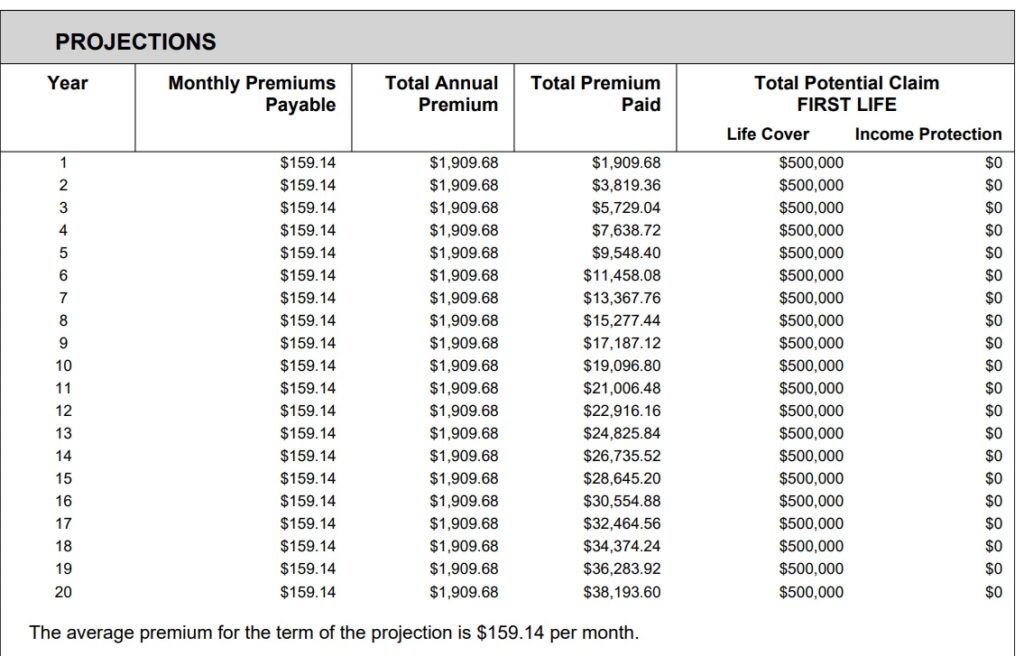

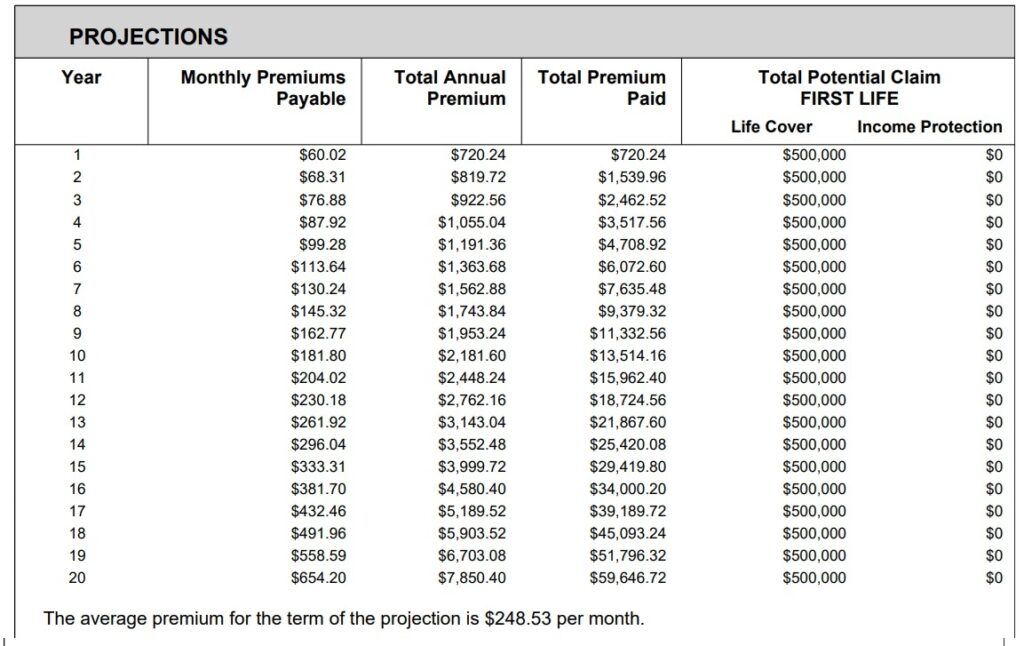

Going 100% on level premiums seems to be considerably cheaper with $38,000 paid over twenty years instead of $59,000 with a traditional rate-for-age approach. However you must also consider inflation, today’s money is worth more than tomorrow’s, hence a balanced approach is advisable.

Typical life insurance premiums 45 yr old male – non smoker

Typical level premiums for 45 yr old male non smoker