Is there a better way to pay off your mortgage? Lets say you can see piles of money coming in and then disappearing from your bank account. And you are the type to over think everything, surely there must be a smarter approach to your home loan.

Pause on Kiwisaver and redirect to home loan repayments?

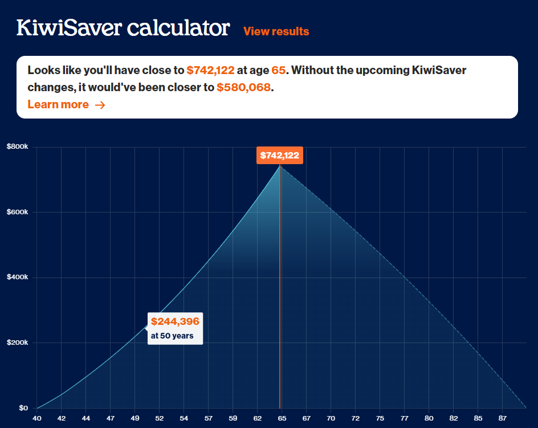

This one didn’t seem to fair too well in terms of smartness. The obvious thing here is employer contributions, this makes it a no brainer that Kiwisaver will win out. Some of the variables here is going to be subject to change. But today on a growth fund using a sorted.org.nz, calculator, It seems a family on approx $300k income pa – would see the fund grow to approx $244,000 in ten years vs being about $120,000 better on the home loan balance (using a 5% mortgage rate). So due to the employer contributions mainly – you would say Kiwisaver is a better approach.

If you are self employed and Kiwisaver is a choice. You will likely be footing both the employer contribution as well the employee contribution for yourself. Then this is a strategy worth running past your financial adviser.

Investment property vs paying down faster?

Looking over a slightly longer time horizon at 15 years, again with some speculative variables. This one steers away from throwing everything at the mortgage. Using a capital gain and interest rate of 5%, the property does an amazing job.

My personal view is that currently it is possible to obtain an investment property in parts of NZ for $550,000 where your input after interest, rates and insurance would be approx $10,000 pa. If you put that instead straight into your home mortgage – you could have a mortgage that is $220,000 lower after 15 years.

However a property of $550,000 could double over 15 years, so this is waaay in favour of the investment property. Some things to consider, you carry more debt with an investment property(interest rates rises have an impact). You could have lumpy maintenance costs and the headache of being a landlord. However rents go up over the long term, so after the first 7-10 years the risks would have been mitigated drastically.

Revolving credit as your cheque account

So traditionally this has been flaunted as a game changer. I have become less of a fan as all too often if it makes the management of funds messy. If this lowers the average balance of your home loan by $10,000 throughout the year, you might save $40 per month. So do this if it feels right and you like to keep a lot of funds in your cheque account.

Revolving credit as your savings account

This make a lot of sense. If you like to keep around $30,000 in backup funds for example, you could be saving about $1,500 per annum on your home loan interest. Using a revolving credit account means it is always available to be drawn on.

If you are comparing this to a typical on call savings accounts – you would be about 3% better off ($900 pa). Offset home loans are another alternative to this which can keep things tidier.